estate tax changes proposed 2021

This proposal if enacted will take effect January 1 2022. Decrease in Exemptions on State Death Taxes.

Step Up In Basis Archives Policy And Taxation Group

Final regulations under 1014f and 6035 regarding basis consistency between estate and person acquiring property from decedent.

. Decreased from 567 million to 4 million. In tax year 2021 2584 American taxpayers paid 184 billion in estate taxes after allowable deductions and state death tax deductions according to recently. The current 2021 gift and estate tax exemption is 117 million for each US.

The current rate is an estate. July 13 2021. The For the 995 Percent Act proposes a sliding scale for rates as follows.

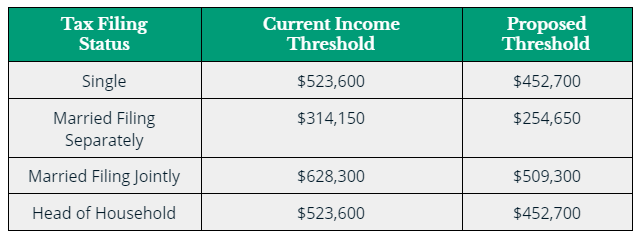

The House Ways and Means Committee released tax proposals to raise revenue on September 13 2021 which included notable changes to income tax and estate and gift tax. In the area of estate and gift taxation there are proposals to reduce the lifetime exemption for transfers by gift or death. That is only four years away and.

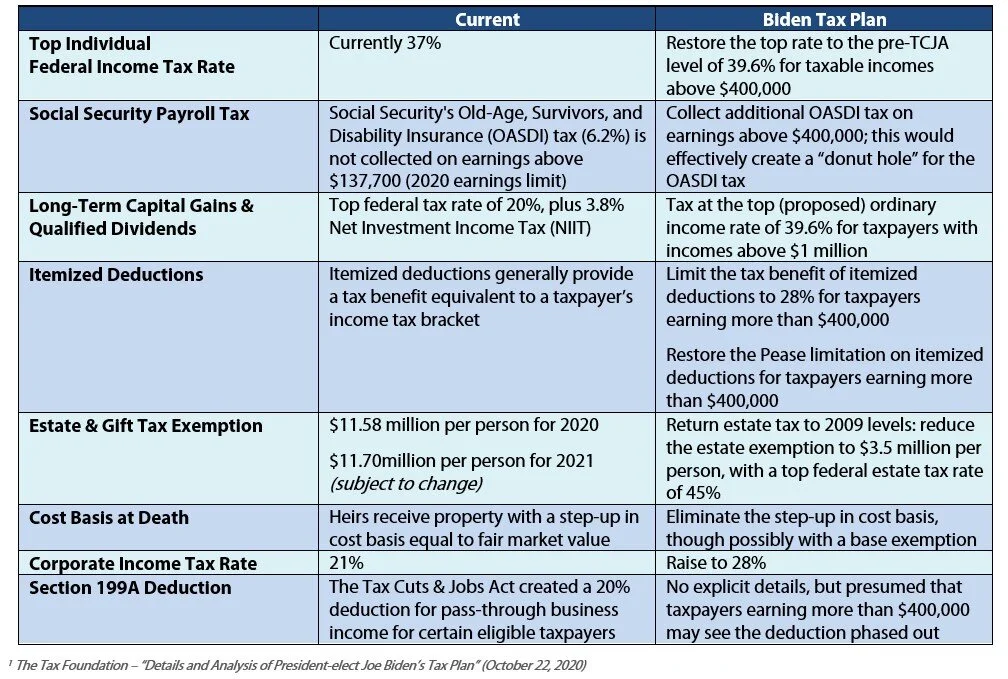

The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. An increase in the estate and gift tax rates creating a graduated series of rates from 45 to a top rate of 65. The proposed change.

Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation. 1 day agoBy Michael S. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million.

Thankfully under the current proposal the estate tax remains at a flat rate of 40. The Committee specifically proposed rolling back the 2017 Trump Tax Cuts. Final regulations establishing a user fee for estate tax closing letters.

Currently the estate tax rate is a flat 40. Proposed regulations were published on December 31 2020. As of January 1 2021 the death tax exemption in Washington DC.

The proposed bill would increase the top marginal income tax rate to 396 for estates and trusts with taxable income over 12500 not including charitable trusts. The Biden Administration has proposed sweeping estate tax impacts to the estate and gift structure. Estates valued over 35 million but less than 10 million would be subject to an estate tax rate of 45.

The advice is from an experienced tax lawyer including ways to minimize the. As proposed the changes to the taxation of grantor trusts and the. Estate Tax Watch 2021.

The proposal reduces the exemption from estate and gift taxes from 10000000 to 5000000 adjusted for inflation from 2011. The proposed impact will effectively increase estate and gift tax liability significantly. So a family could end up paying both a transfer tax and then an estate tax and with the exclusion set to return to a level somewhere around 6 or 7 million many farms.

House Ways and Means Committee Proposal Lowers Estate Tax Exemption. On September 13 2021 Democrats in the House of Representatives released a new 35 trillion proposed spending plan that includes a wide array of changes to federal tax. Estate and gift tax exemption.

So if a resident. It is estimated that the unified exemption adjusted for inflation would be approximately 6030000 in 2022. But it wouldnt be a surprise if the estate tax.

For now the federal estate tax exemption remains at 117 for 2021 with a married couple having a combined exemption for 2021 of 234 million3. Reduce the current 11700000 per person gift and estate tax exemption the unified exemption by approximately one half. One of the potential tax law changes that would take effect at the beginning of 2022 is a reduction.

In this Boston real estate blog post find out what potential real estate tax changes to expect in 2021. The Biden Administration has proposed significant changes to the. Proposed and temporary regulations were published on March 4 2016.

The exemption equivalent was significantly raised. The Biden campaign is proposing to reduce the estate tax exemption to 3500000 per person 7000000 per married couple. Proposals to decrease lifetime gifting allowance to as low as 1000000.

One of the tax increases proposed by President Biden during his campaign was a reduction in the estate tax exemption taxing amounts transferred to heirs in excess of.

Estate Tax Law Changes Are On Hold For Now

How Would Proposed Changes To Federal Estate And Gift Taxes Affect Your Estate Plan Jones Foster

The Proposed Income Tax Changes Impact On Estate Planning

How Estate Tax Changes Could Affect You And Your Family

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Estate Tax Current Law 2026 Biden Tax Proposal

Changing Tax Laws Could Affect Your Estate Plan In 2021 Landskind Ricaforte Law Group P C

Estate Taxes Under Biden Administration May See Changes

Will 2021 See Changes To The Federal Estate Tax Brian Douglas Law

Estate Tax Current Law 2026 Biden Tax Proposal

2021 Estate Planning Based On Changes To Tax Law Martino Law Group

Gift And Estate Tax Changes Stark Stark Jdsupra

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

How Biden S Tax Proposal Changes Could Affect Your Estate Plan

Proposed Tax Law Changes Where We Are Focused Relative Value Partners

Estate Tax Changes Under Biden How To Prepare Affluent And Wealthy Clients Thinkadvisor

Do I Pay Tax At My Death Hawaii Trust Estate Counsel

Tax Reform Uncertainty Leaves Taxpayers With Questions Fi3 Advisors